About Team Internet

Team Internet is a leading global internet solutions company operating in two highly attractive markets.

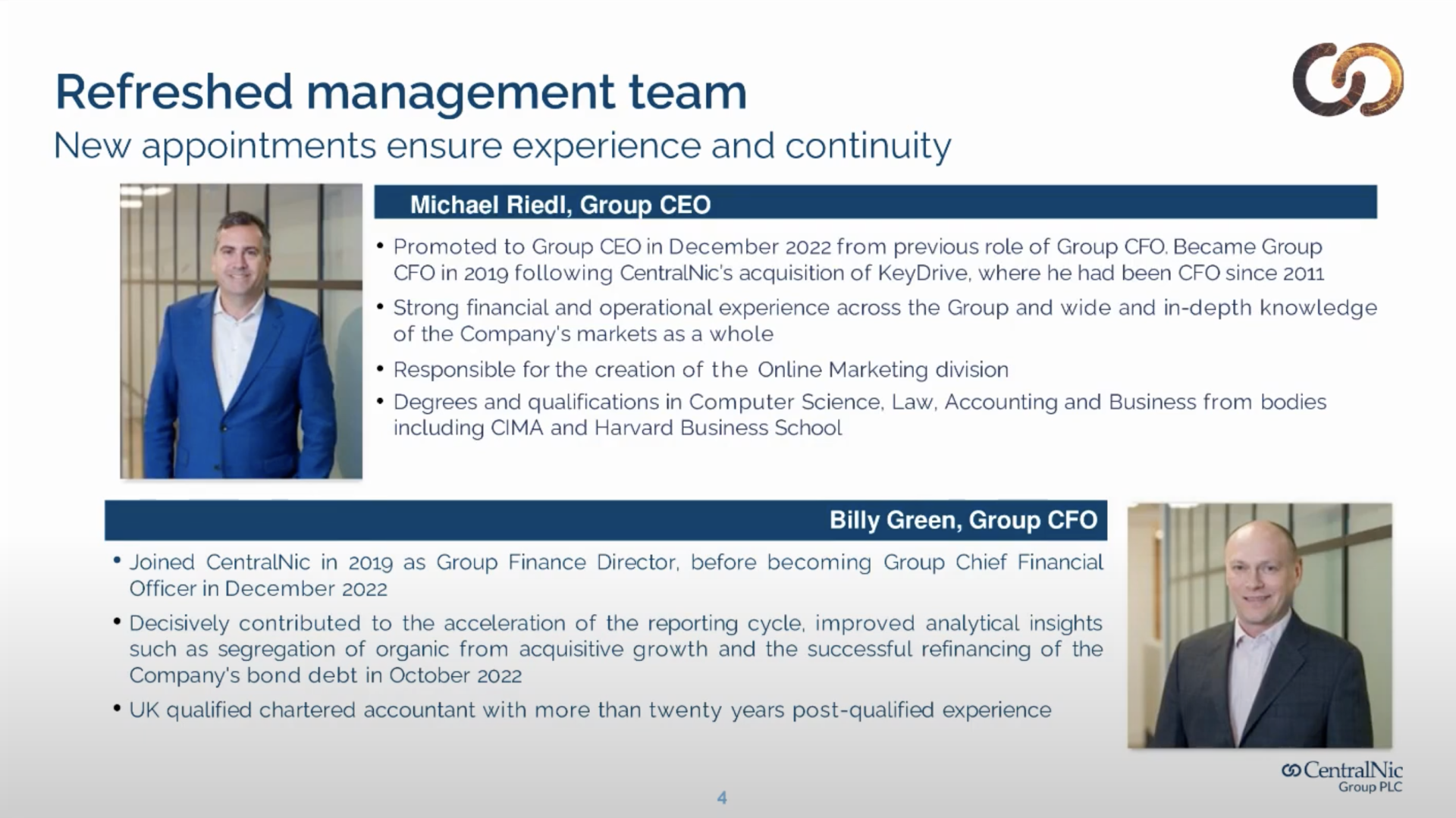

Our proven business model is backed by straight-forward KPI, high-quality earnings, scalable technology and an experienced and entrepreneurial management team.

18th Mar 2024

18th Mar 2024